Business Activity Statement Forms

Business Activity Statements are used by Australian Businesses to report and pay tax obligations to the Australian Tax Office (ATO). For most sole traders and small businesses this includes reporting Goods and Services Tax (GST) and Pay as You Go (PAYG) installments.

How do I Complete my Business Activity Statement Video

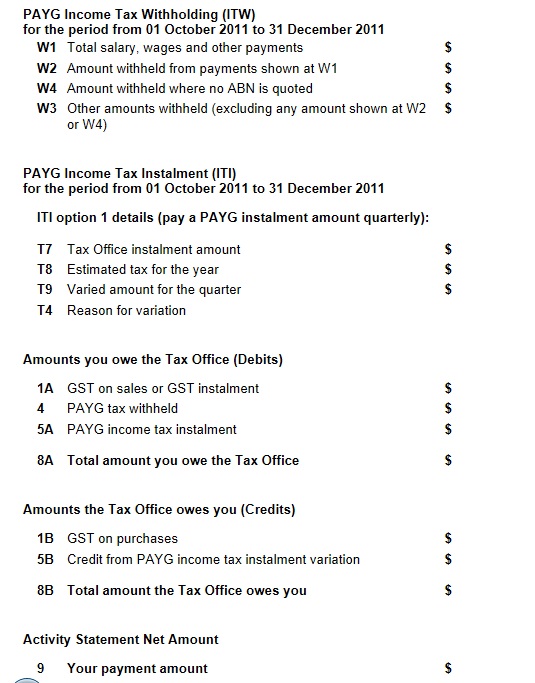

The Business Activity Statement is basically a record of business revenue, expense, goods and services tax received and goods and services tax paid for the period. These form the basis of calculations to determine the businesses Goods and Services Tax liability and income tax installments. For small business this is commonly reported quarterly.

You can submit your Business Activity Statement online via the ATO's Business Portal. To use the ATO Business Portal you need to register for an AUSKEY and install it on your computer. Alternatively you can complete the ATO's hard copy Business Activity Statement Form.

The ATO encourages online BAS form completion:

If you're a business, you can lodge your activity statements online or use a paper form. Lodging online is quicker and most quarterly lodgers get an extra two weeks to lodge (terms and conditions apply).

If you are using the business portal the ATO will email you when your Business Activity Statement is available. If you are not using the business portal the ATO will mail you a hardcopy BAS Form for completion and return.

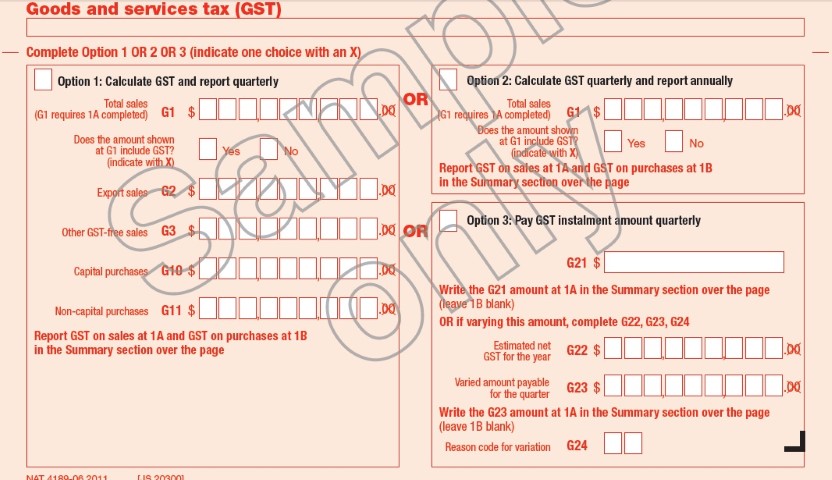

Goods and Services Tax (GST) section of the Sample hardcopy BAS Form

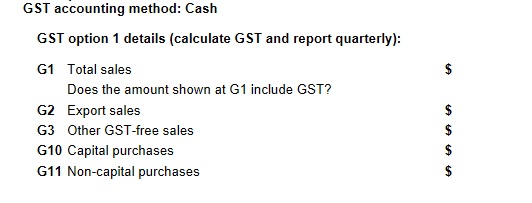

The Business Activity Statement form includes BAS Codes which align with specific BAS Calculation amounts. BAS calculations with applicable BAS codes are displayed when you click BAS View in BAS-I.C.

BAS Codes are also applicable when completing your Business Activity Statement online via the Business Portal.

How do I Complete my Business Activity Statement? provides further detail.

See BAS-I.C Topics for additional topic help pages and BAS-I.C Videos for a full list of video tutorials.